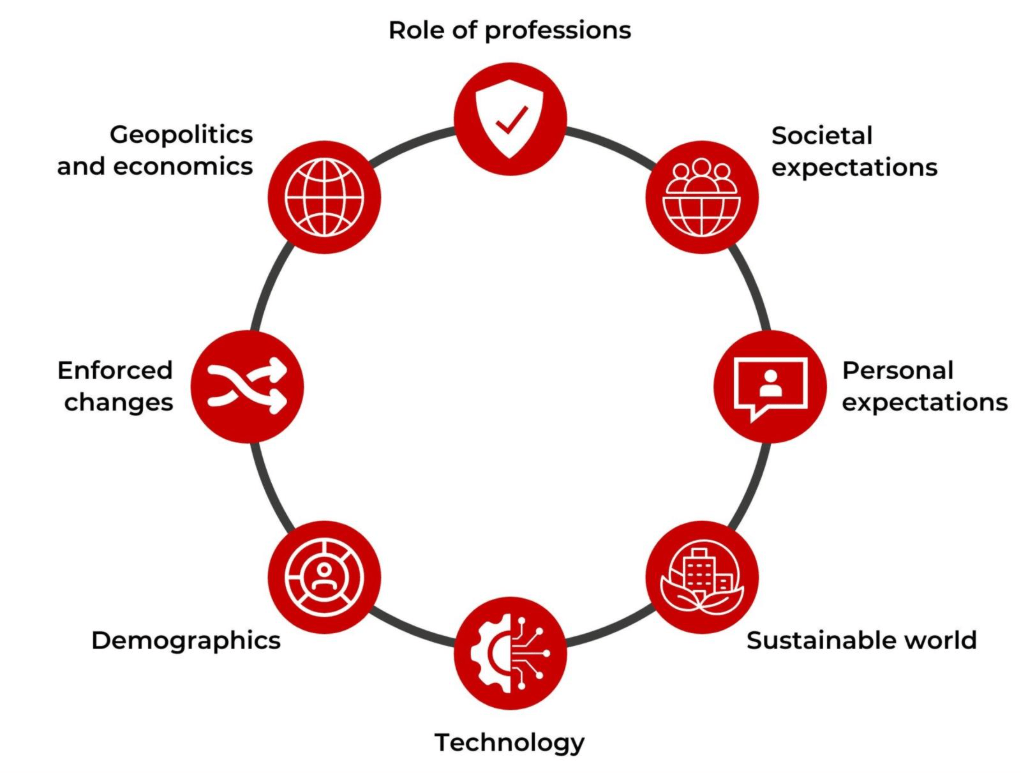

Employers should seek to review their traditional career models. Advances in technology – reducing or transforming entry-level roles and changing the nature of the roles themselves. Demographic changes – lengthening the working life. Flattening economic performance – making sideways moves more important for career and financial progression. Disenchantment with the impact of more senior or executive roles on work-life balance and the immediate financial and lifestyle needs driving chosen career paths – particularly during economic and geopolitical uncertainty. Report author Clive Webb, head of business management at ACCA, said: ‘The report shows that those who appreciate and adapt to the changes will benefit from stimulating and rewarding careers in finance and accountancy. For employers, this underlines the importance of creating career frameworks that support mobility, continuous learning and the evolving aspirations of today’s workforce.’ Survey respondents ranked technology as the most significant of eight drivers of change reshaping future career paths and workplaces, with changes in personal expectations of work coming in second place, and other drivers shown in the order below: 1. Technology: Emerging technologies, automation, and data analytics dominate future work and how the human augments the machine, including artificial intelligence (AI). 2. Personal expectations: Increased emphasis on the motivators for work – such as work-life balance, purpose and flexibility. 3. Societal expectations: Evolving views on the role and value of work. 4. Geopolitics and economics: Slower growth and global fragmentation challenging personal prosperity. 5. Role of professions: Changing from guardians of knowledge to interpreters and trusted advisors. 6. Enforced changes: Reaction to external changes of increasing compliance and the need for greater ethical oversight. 7. Sustainable world: Climate change and other sustainability factors impacting where, when and how we might work, as well as imperatives creating new roles and responsibilities. 8. Organisational structures: An evolution of organisational structures – removing traditional middle-level roles and replacing them with more specialist roles. In a new survey by ACCA (the Association of Chartered Certified Accountants) 53% of Middle East respondents believed that flexible career paths will replace linear paths within the next decade. Career breaks and ‘micro-retirements’ are likely to increase as professionals work longer. ACCA chief executive Helen Brand said: ‘Accountancy is being redefined in ways that are reshaping and expanding the role of the profession. Taking greater ownership of your career and learning is key – continually developing the right skills is essential to navigating a flexible workplace.’ Reflecting on the regional findings, Kush Ahuja, Head of Eurasia and Middle East at ACCA, said: ‘The Middle East is a uniquely dynamic market, shaped by global connectivity, rapid economic transformation and ambitious national development agendas.’ ACCA’s regional data shows strong confidence in future career prospects, alongside growing expectations for flexibility, international mobility and skills-based progression. Preparing for this flexible career structure is at the core of suggested actions made in ACCA’s major new report, ‘Career paths reimagined’. Our research shows a strong sense of optimism across the region, with finance professionals increasingly focused on building flexible, skills-led careers that can move across sectors and borders. Entry points are evolving and are being redefined by new ways of working and a demand for specific skills and experience. Employers need to adapt to and anticipate changes now to maximise talent, match skills demand and provide a sustainable pipeline of talent for a redefined profession.’ While traditional career paths are giving way to more flexible, individualised routes that are shaped by skills rather than titles, opportunities to grow and thrive have never been greater for those prepared to embrace change.’ ‘To be successful, finance professionals must be willing to let go of outdated expectations and embrace a future which will see the rise of hyper-personalised careers featuring more flexibility but less predictability.’